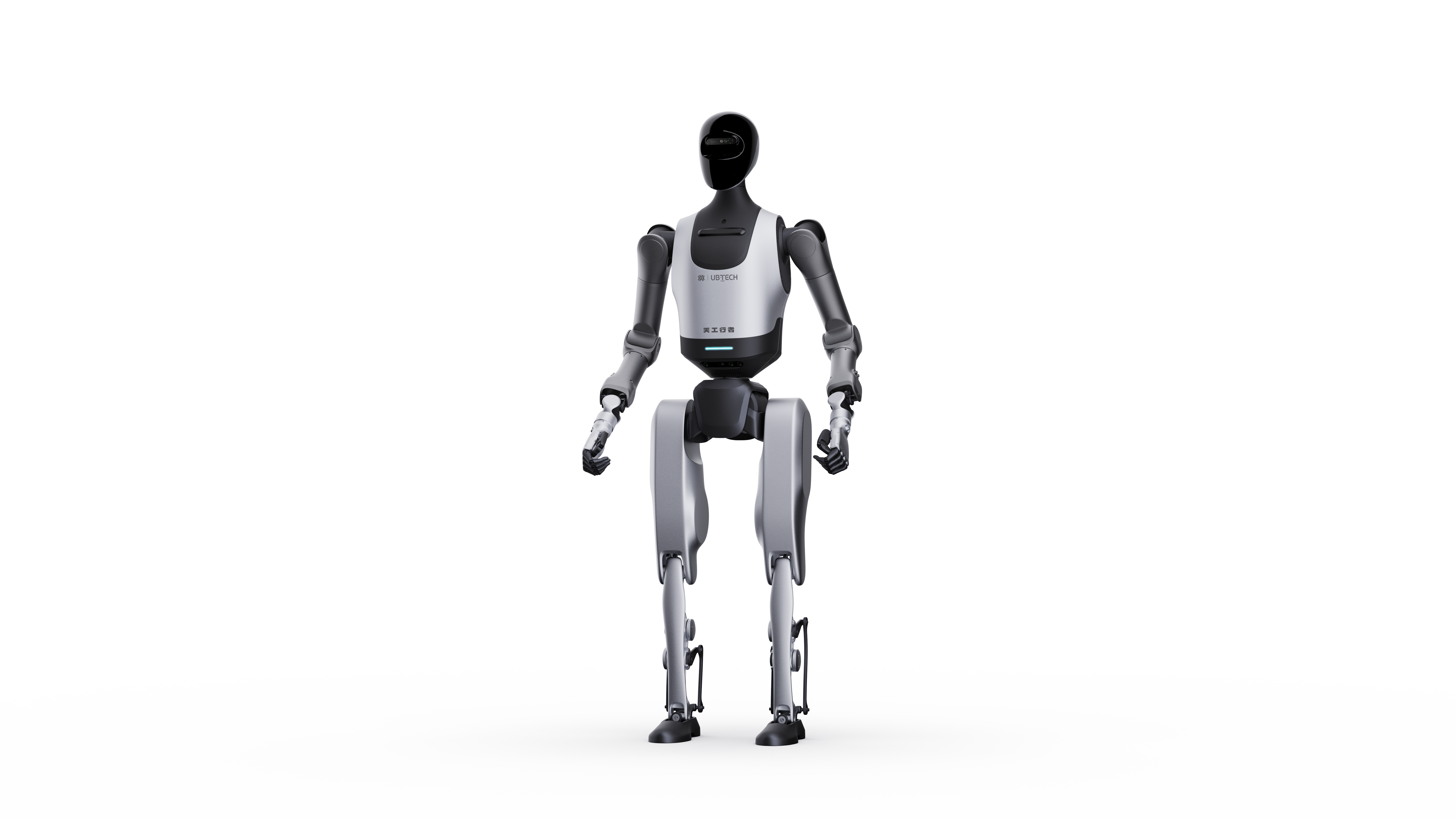

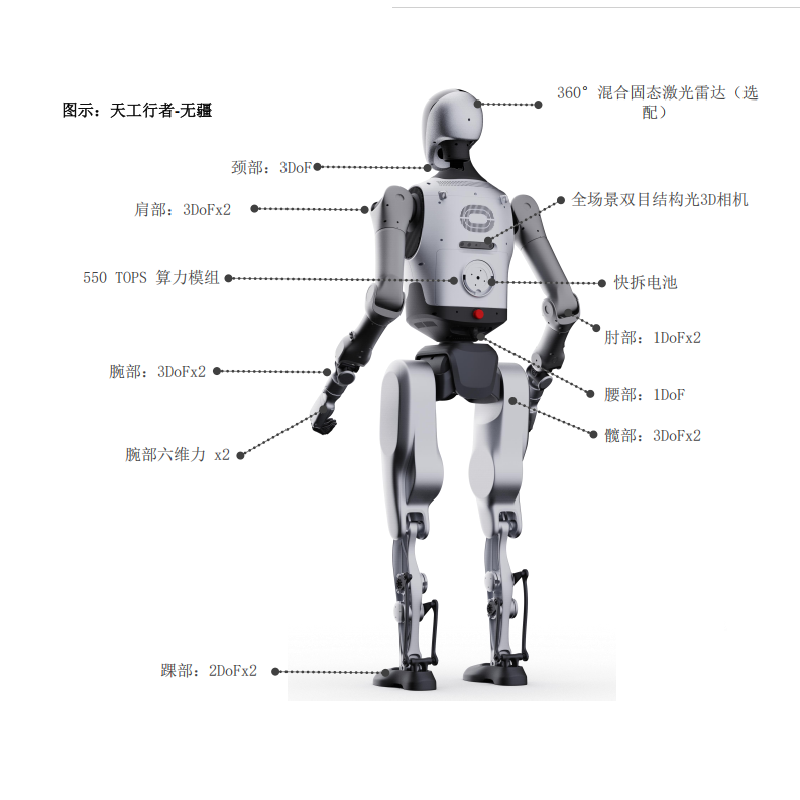

banking robots

Banking robots represent a revolutionary advancement in financial services automation, combining artificial intelligence, machine learning, and robotic process automation to transform traditional banking operations. These sophisticated systems handle various banking tasks, from customer service interactions to complex financial transactions. The robots utilize natural language processing to communicate with customers through multiple channels, including chat, email, and voice interactions. They can process account inquiries, execute transactions, verify identities, and provide personalized financial advice 24/7. The technology incorporates advanced security protocols, including biometric authentication and encryption, ensuring secure banking operations. Banking robots can analyze vast amounts of data in real-time, enabling them to detect fraudulent activities, assess credit risks, and provide tailored financial recommendations. They streamline back-office operations by automating routine tasks such as data entry, document processing, and compliance checking, significantly reducing processing time and human error. These systems also integrate seamlessly with existing banking infrastructure, providing a unified platform for both digital and traditional banking services.