insurance company robots

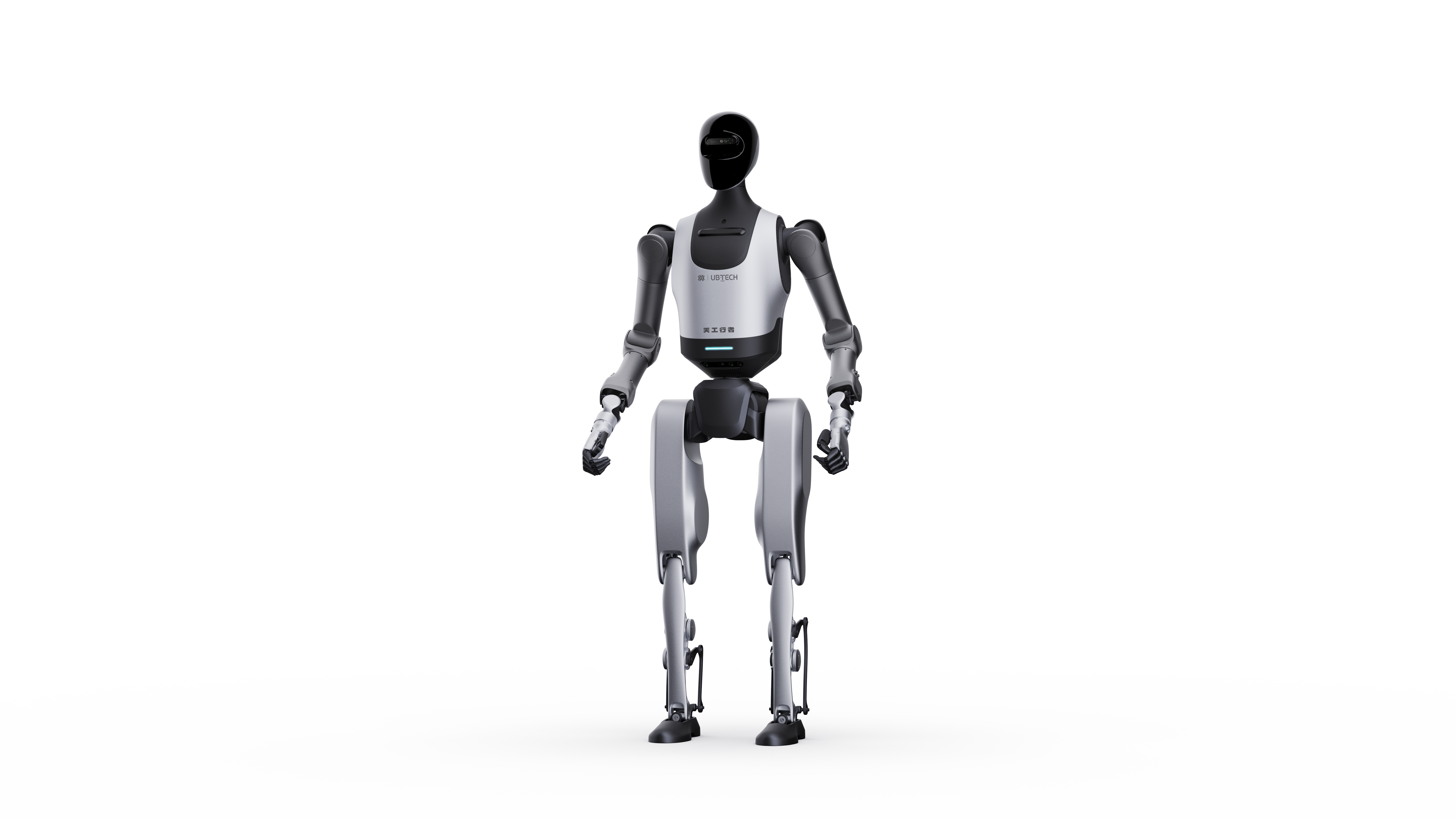

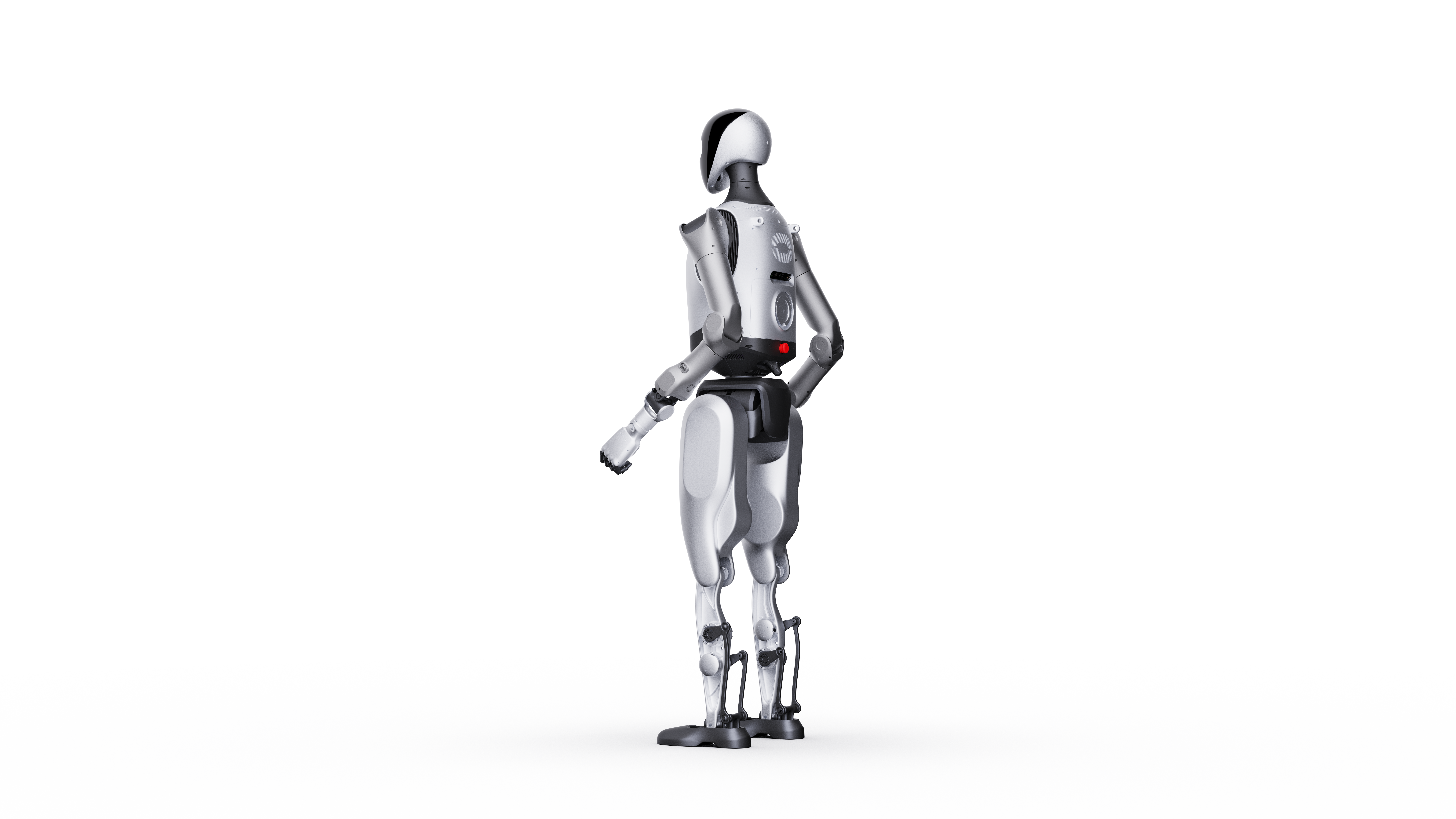

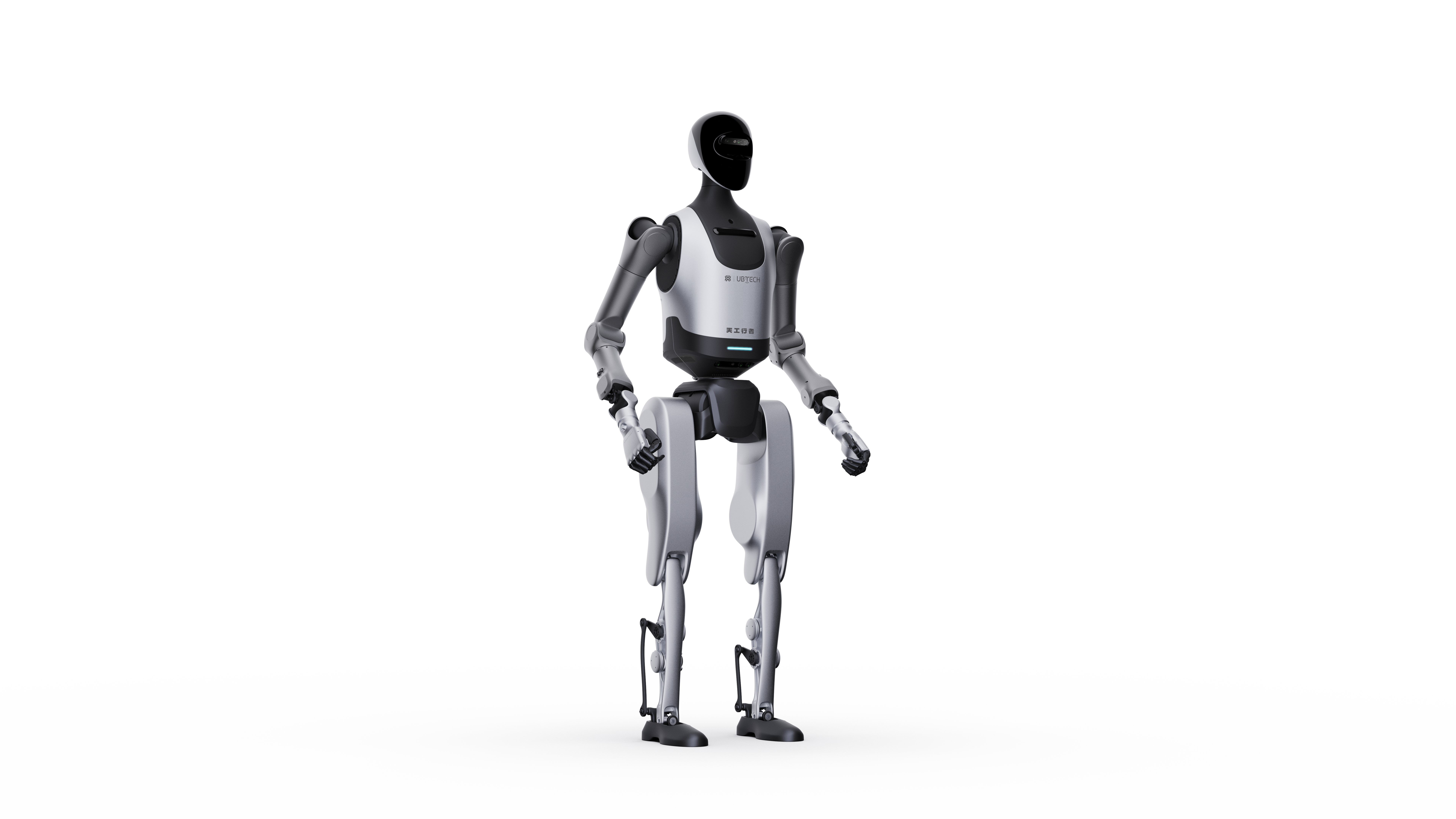

Insurance company robots represent a groundbreaking advancement in the financial services sector, combining artificial intelligence with automated processing capabilities to revolutionize insurance operations. These sophisticated systems handle multiple tasks, from claims processing to customer service interactions, operating 24/7 with consistent accuracy. The robots utilize advanced machine learning algorithms to analyze documents, assess risks, and make data-driven decisions. They can process claims documentation, verify policy information, and detect potential fraud patterns with remarkable precision. These systems are equipped with natural language processing capabilities, enabling them to understand and respond to customer inquiries through various channels. The technological infrastructure includes cloud-based processing power, secure data handling protocols, and real-time analytics engines. They seamlessly integrate with existing insurance databases and can handle multiple policies and claims simultaneously. The robots also feature adaptive learning capabilities, continuously improving their performance based on new data and interactions. Their applications span across various insurance sectors, including auto, health, life, and property insurance, providing consistent service quality while reducing operational costs and human error.